LIFE INSURANCE

Secure Your Loved Ones' Future

Providing peace of mind, financial stability, and protection for your family in the event of unexpected circumstances.

What You Don't Want

An Uncertain Future

Not having life insurance can lead to financial insecurity and difficulty planning for the future, as loved ones may struggle to cover expenses and debts, and individuals may need to use their savings to address unexpected expenses. This can leave loved ones in debt and with long-lasting financial consequences.

Financial Insecurity

Without life insurance, loved ones may struggle to cover funeral expenses, pay off outstanding debts, and maintain their standard of living in the absence of the deceased's income.

Inability to Plan For The Future

The lack of a safety net can make it difficult for individuals to plan for their future, as they may have to allocate a portion of their savings to cover potential unexpected expenses or emergencies.

Leaving Loved Ones in Debt

In addition to being emotionally devastating, the loss of a loved one can also have long-lasting financial consequences, as debts and unpaid bills may fall on family members to settle.

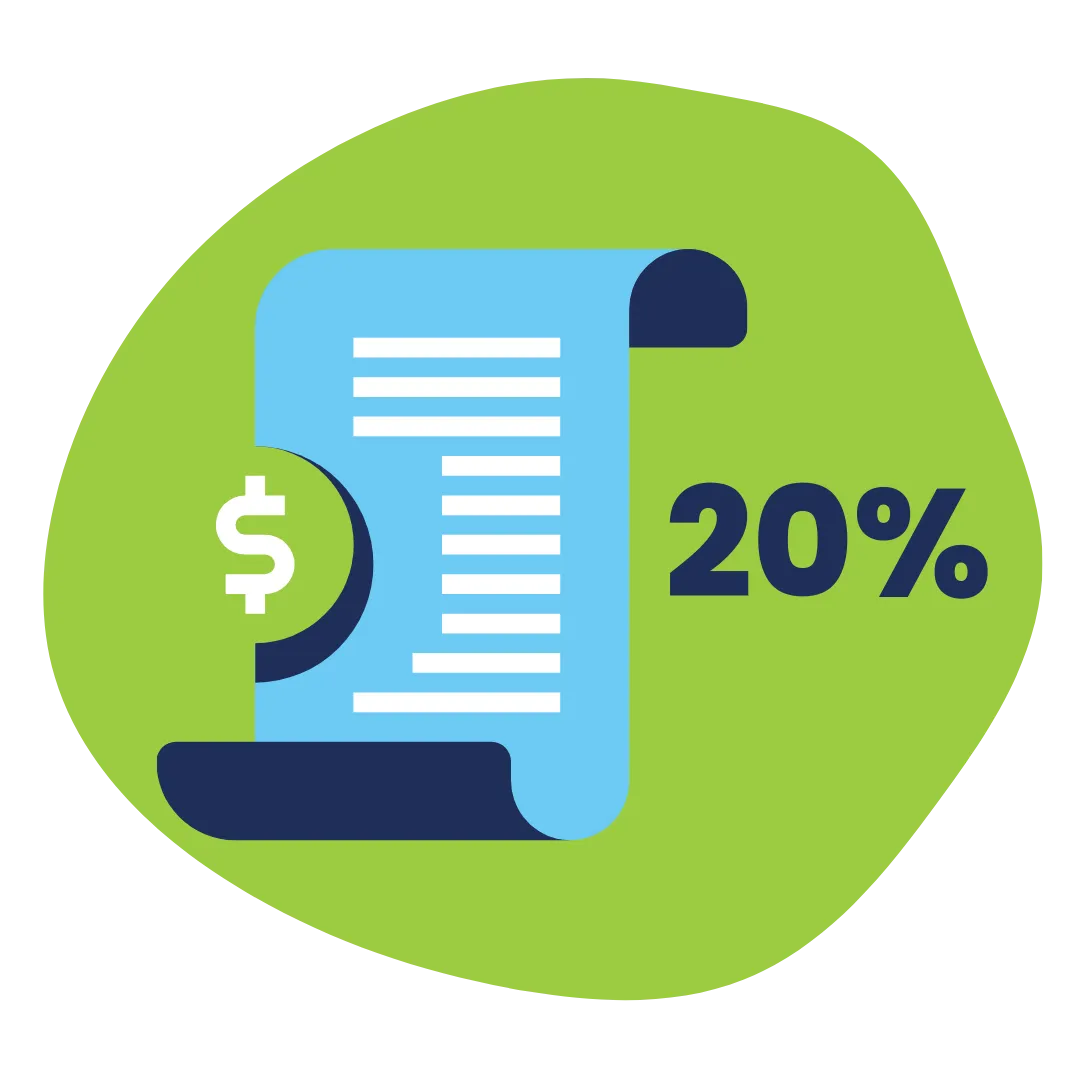

You're Responsible for the 20%

Once you've paid your deductible, Medicare covers 80% of your medical and hospital expenses. You're responsible for covering the remaining 20%.

These Deductibles Can Increase

Medicare has deductibles for both Part A (which covers hospital stays) and Part B (which covers doctor visits and other outpatient services). These deductibles can increase from year to year, so it's important to keep track of them.

There Is No Maximum Limit

Medicare does not have a Maximum Out-of-Pocket (MOOP) limit, which means that there is no cap on the medical or hospital expenses in a given year.

Consider Additional Options

Pay attention to the costs associated with Medicare coverage and to consider additional insurance options (such as Medicare Advantage plans or Medigap policies) to help cover some of the costs that original Medicare doesn't fully cover.

Solutions

How Life Insurance Can Help

Life insurance offers multiple benefits to policyholders and their loved ones. It provides financial security in the event of the policyholder's death, covering expenses such as funeral costs, debts, and ongoing living expenses. It can also be used for estate planning, protecting businesses and stakeholders, and providing a source of supplemental retirement income. Perhaps most importantly, life insurance provides peace of mind, knowing that loved ones will be taken care of in the event of the policyholder's unexpected death.

Financial Security

Life insurance can provide financial security for loved ones in the event of the policyholder's death, by providing a lump-sum payment that can cover funeral expenses, outstanding debts, and ongoing living expenses.

Estate Planning

Life insurance can also be used as a tool for estate planning, allowing policyholders to name beneficiaries and pass on assets to their loved ones without the need for probate.

Business Protection

For business owners, life insurance can provide protection for the business and its stakeholders, by providing funds to cover business debts, buy out a deceased partner's share of the business, or fund key person insurance to ensure the business can continue in the event of the loss of a key employee.

Supplemental Retirement

Some types of life insurance can also provide a source of supplemental retirement income, by accumulating cash value over time that can be withdrawn or

borrowed against.

Charitable Giving

Life insurance can also be used as a way to make charitable donations, by naming a charity as the beneficiary of the policy. This can be a meaningful way for individuals to give back to their community and leave a legacy.

Peace of Mind

By knowing that their loved ones will be taken care of in the event of their unexpected death, policyholders can feel secure in their financial planning and can focus on enjoying their life without worry or stress about the future.

Overall, life insurance is an essential tool for financial protection and planning, providing security and comfort for both policyholders and their beneficiaries. Work with an insurance professional like Luis Daza to determine the types and amounts of coverage that life insurance can provide

MEDICARE TIP OF THE DAY

It's a good idea to talk to an insurance agent who really knows about Medicare to make sure you're getting the right kind of help with your healthcare costs.

Someone with at least 15 years of experience, knows the ins and outs of insurance like the back of his hand and has a genuine desire to help his clients get the best solution suitable to their needs.

Hi! I'm

Luis Daza

I am an Insurance agent who has had the privilege of serving, and the honor of gaining the trust and loyalty of our local senior community since 2008 - over 15 Years.

I am an Insurance agent who has had the privilege of serving, and the honor of gaining the trust and loyalty of our local senior community since 2008 - that's over 15 Years!

What To Expect

Our Process

1. Educate

We make sure you are well-informed and updated with life insurance

2. Needs Analysis

Lets analyze your needs, your wants, your preferences.

3. Plan Selection

We help you pick few but the best options for you.

4. Implementation

We make the transition easy and simple for you

5. Monitoring

Once implemented We’ll make sure you are fine.

6. Relationship

We stay in touch with you to make sure you are doing the best.

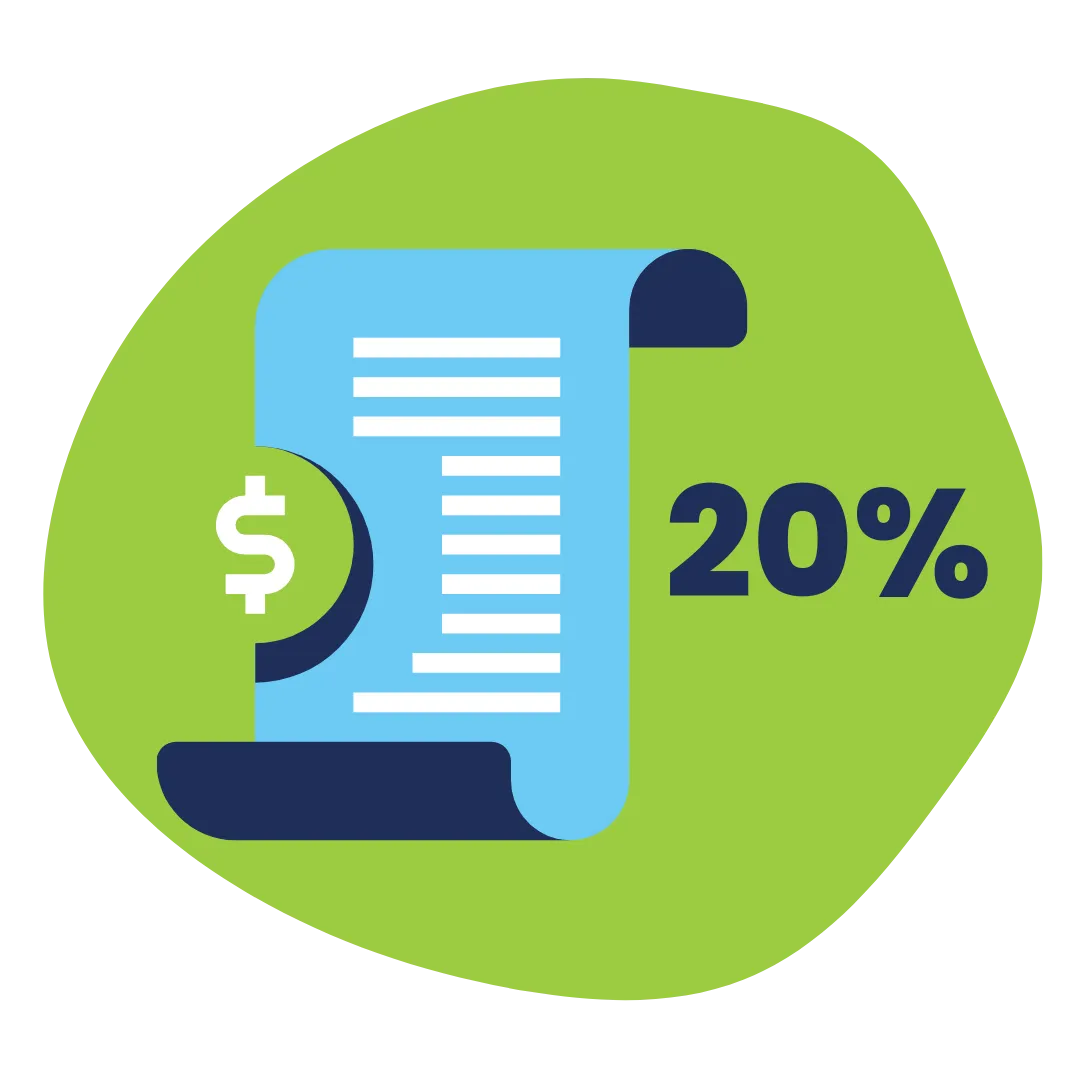

You're Responsible for the 20%

Once you've paid your deductible, Medicare covers 80% of your medical and hospital expenses. You're responsible for covering the remaining 20%.

These Deductibles Can Increase

Medicare has deductibles for both Part A (which covers hospital stays) and Part B (which covers doctor visits and other outpatient services). These deductibles can increase from year to year, so it's important to keep track of them.

There Is No Maximum Limit

Medicare does not have a Maximum Out-of-Pocket (MOOP) limit, which means that there is no cap on the medical or hospital expenses in a given year.

Consider Additional Options

Pay attention to the costs associated with Medicare coverage and to consider additional insurance options (such as Medicare Advantage plans or Medigap policies) to help cover some of the costs that original Medicare doesn't fully cover.

Happy Clients

"I lost my spouse unexpectedly a few years ago, and the life insurance policy that we had in place was a huge help during a difficult time. The payout provided financial stability and allowed me to focus on grieving without worrying about the future. I can't emphasize enough how important it is to have life insurance in place to protect your loved ones."

~ Rachel, Age 42.

"I have a young family and knew that I needed to have life insurance to protect them if something were to happen to me. The policy I chose provided peace of mind knowing that my family would be taken care of if the worst were to happen. The process of getting coverage was easy, and the premiums are affordable."

~ Mark, Age 35.

"I've had life insurance for several years, and it's been a great investment. I recently retired and am living off my savings, but I know that my life insurance policy will provide a legacy for my family when I'm gone. It's a way for me to leave something behind for them, even if I'm not there to provide for them myself."

~ Thomas, Age 65.

"I'm Glad I spoke with Daza, before I turned 65. Daza helped me to navigate the maze of Medicare"

~ Jason Silverman

How Can I Help You?